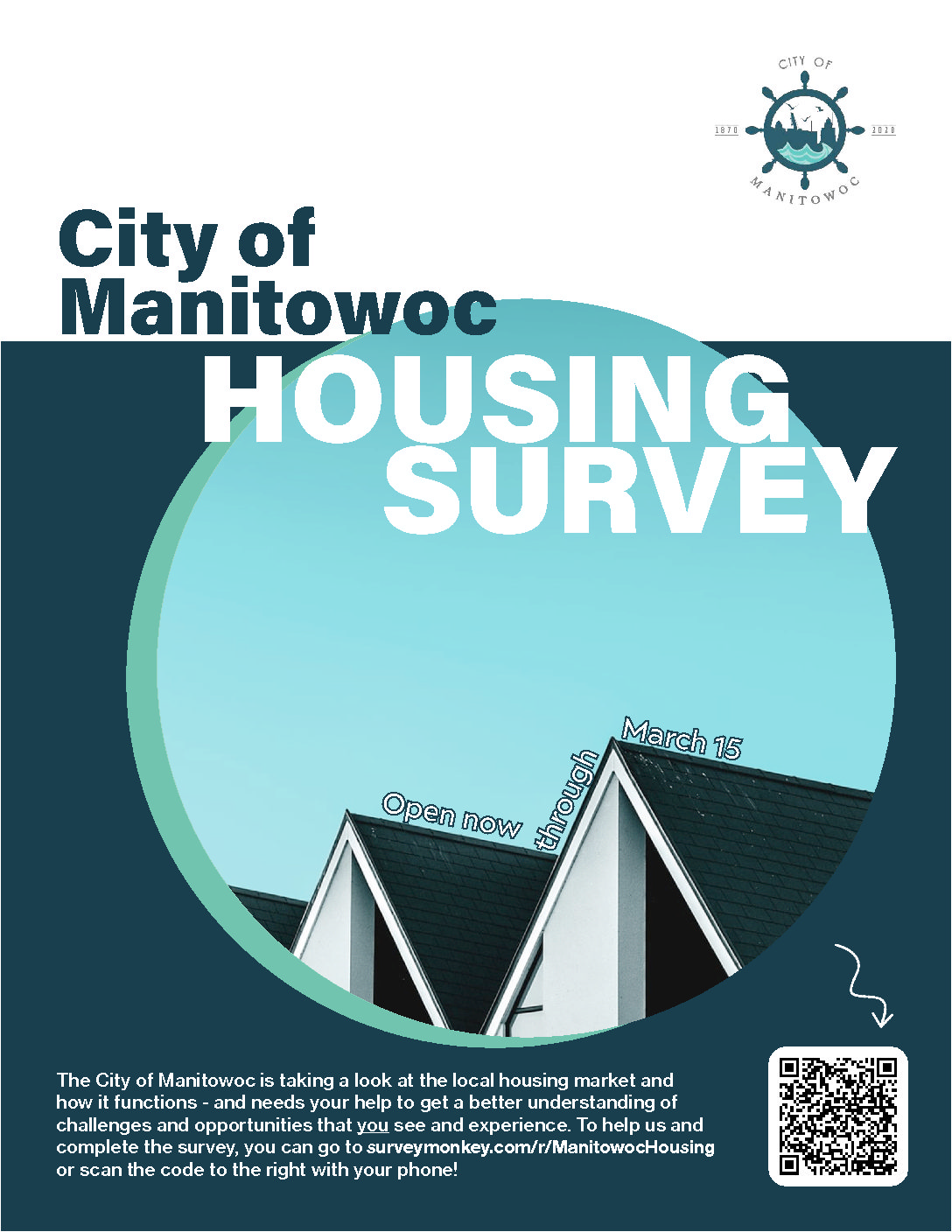

Complete the Manitowoc Housing Survey!

CITY OF MANITOWOC NEEDS YOUR HELP IN DEFINING HOUSING CHALLENGES AND OPPORTUNITIES!

The City of Manitowoc is taking a look at the local housing market and how it functions. They need your help to get a better understanding of challenges and opportunities you see and experience.

ADD YOUR VOICE HERE!

The Housing Survey can be completed online at https://www.surveymonkey.com/

Lakeshore Community Action Program has programs to assist homeowners and renters. Pre-screen applications for WERA (Wisconsin Emergency Rental Assistance), Mortgage Assistance and Property Tax Assistance are located on our Home page at: https://lakeshorecap.org/

Join Us – Social Media